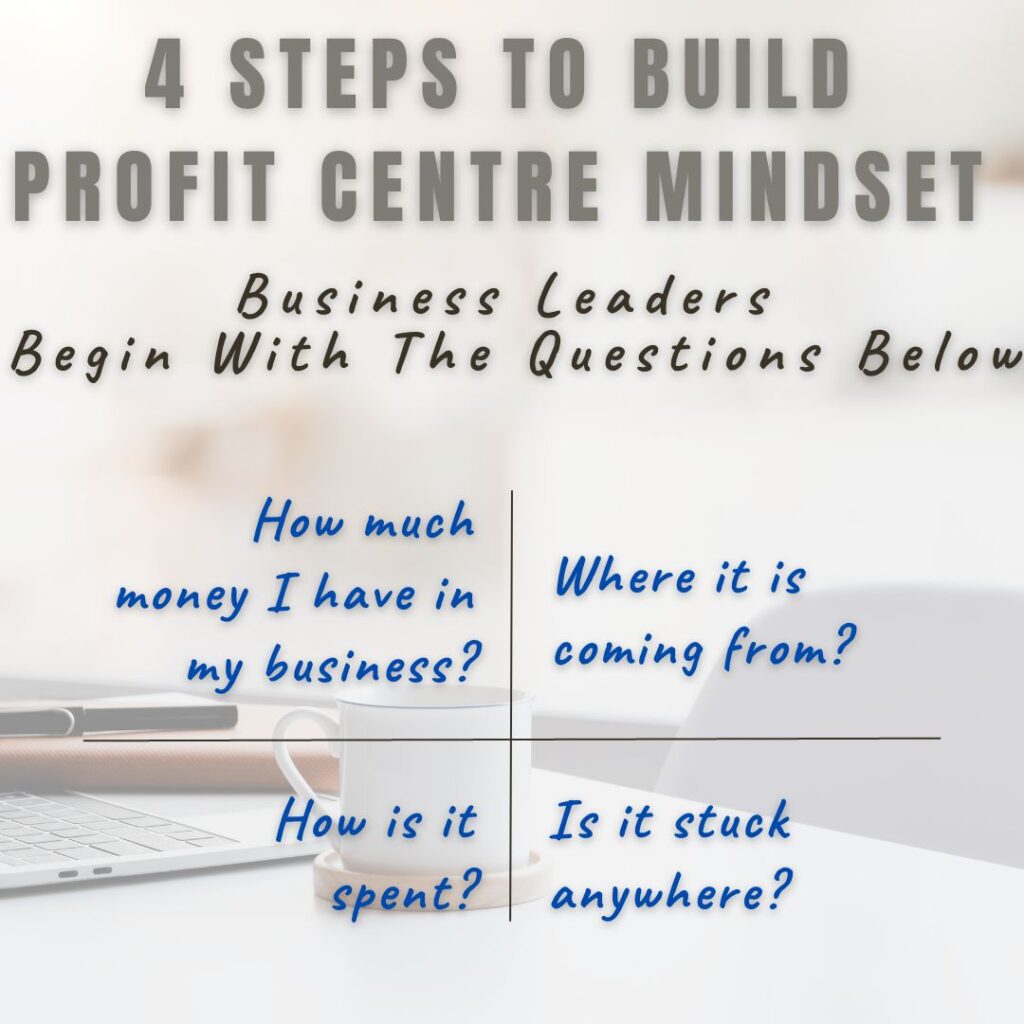

How much money I have in my business?

Where it is coming from?

How is it spent?

And, is it stuck anywhere?

From the very first moment you ask these questions and drill down deeper, you are programming yourself towards adopting Profit Centre Management in your company. You started developing a mindset.

Mindset means ‘a habitual mental attitude that determines how you interpret and respond to situation’.

As the owner, situation in business operations means, utilizing money most efficiently (maximum utilization) and effectively (with tangible results). Early collection of outstanding, cutting down interest cost are indicators of efficiency. Investing on a new machinery or technology to improve productivity shows the effectiveness.

What is Profit Centre Management. It is to manage every element of business operation to its maximum potential. Increasing revenue, identifying new sources of income, cost management, productivity increasing, business expansion, customer relations, process/technology/skill upgradation all are included. As, each and every parameter, contribute towards sustainable business and profitability.

A set of systems (Business MIS, Annual Operating Plan, Targets and Reviews, Budget and P&L Reports etc.) are part of Profit Centre Management.

But, before getting into all these, every business leader should answer themselves the question. “Why am I doing these?

This is what we call the mindset.

By going through the 4 questions about the money in business, we get aligned to the right mental attitude, that’s is the mindset. Once mindset is built, rest of the actions we will do.

Let’s see the questions again,

How much money I have in my business?

This the money you brought in. Own fund or borrowed. Cash or credit or materials. Take measurement of cumulative (from the beginning of business) or consider for period (3, 5 years). You could have added or withdrawn the money.

Get a complete statement prepared and get the complete picture.

Where it is coming from?

Revenue channels like sales, service, commission etc. Or rent, incentives. Is it coming regular (daily sales) or periodic (quarterly/annually).

This data triggers the ways and means to increase inflow.

Now check, are you missing out any more possible money inflow sources. It could be selling scarp materials, adding product line, utilizing untapped infra/people.

How is it spent?

Businessmen often get mislead here. They think only about expenses. But cash outflow has got many channels. That too visible and hidden. Some of them are mentioned below,

Expenses – Categorize expenses into fixed, variable, direct, indirect, interest, tax etc. It also occurs as regular/recurring, periodic, onetime. Analyzing these categories help you to understand it better and take controls.

Capital Expenses- Money you had used in capital expense as well. Infra, land & building, technology etc. Check the ROI (return on investment) each of these, take corrective measures for improvement.

Working Capital Erosion – Operational loss, damaged inventory, bad debt etc. are hidden elements which takes away your money.

Stock – Large amount of companies are struggling on the cash blocked in stock. Check how much excess/slow/dead stock have consumed your money. Raw material, work in progress and finished goods all are to be considered. Ageing inventory is to be taken very seriously. It consumes money and interest and cuts down profitability.

Outstanding – Efficiency of outstanding collection is highest game changer of your cash. The better collection is done higher will be the cash availability. A bad debt is your loss of money.

Other Receivables – Channel commission, annual incentives, advance paid are example.

Begin with these parameters. Seek help of an expert (accountant) if needed.

Next progression shall be to P & L Report, Budget and AOP (annual operating plan).

Business MIS is essential to facilitate this financial modelling.