Are you in a business leadership role?

Business owners, CEOs, General Managers, Department Heads, Accounts & HR Leaders. All are in business leadership.

Then, investing your time on profit centre management practice is worth a lot!

Many of you know that, Profit Centre Management is not about running a business for a profit alone.

It is a tried-and-true professional approach for organizational performance in total. In particular for growth and profitability.

So, leaders representing every operational area of business are vital.

Profit centre management measures your company’s ‘financial’ as well as ‘performance’ parameters.

It reveals the precise position of the company’s operations.

It makes you work with real-time data. Help you make rational and data-driven decisions.

You need not land up in rash or impromptu decisions. Whether it’s a sales promotion, employee benefits or a procurement.

You can forecast company performance on an annual basis. Or even ahead.

You know precise where all revenue generated. Where the leaks are. All aspects of performance, deviations and non-performance.

As you know profit is not a direct outcome. It’s a mash-up of several factors. Income, expense, cost control, inventory and customer retention are all common concerns.

Like every business, your company also have a unique profit plan. This is the indicator for expansions and investment.

Implementation Plan

If you agree up to this point, then we will move to the implementation plan.

To begin with, consider your company operation into two different sides.

First, The Business process. This is ‘WHAT’ you do to run your business. Let’s say, it is your domain (sales, trading, manufacturing, customer service and so on)

Second, The Management process. This is ‘HOW’ you manage the business. Let’s say management process. Financial accounting, HR, Productivity, Annual Operating plan are few to examples.

Remember, Business Process is unique for every company. But 80% of management process are common.

You have seen large companies working. They all adopt common management process. Like AOP (annual operating plan), Budget, Income Statement, Cash flow, Sales Plan, Inventory Control, Legal & Compliances etc.

Now, check your own company and see all required management process are in place.

For example, if you have large inventory. (Stock of raw material, work in progress/semi-finished goods & finished goods). You definitely need to have ‘inventory management process’. (Inventory management includes optimum stock identification, systematic procurement, storage & handling, stock issue, dispatch. It also deals with fast/medium/slow/dead stock as well as high/medium/low value stock).

If you are selling on a credit basis, please be sure that you have proper debt management process.

If your company have more than 50 employees. Your need is right HR process and performance management.

More examples are beyond the scope of this article. (Please subscribe to blog list, we will update you on free webinars on this topic).

There will be more areas which even did not notice by you.

Profit Centre Management is a management process to identify and fix all the above-mentioned concerns.

This is not single step action. You have to adopt the method and process on every element of your business on a daily basis. This is continuous build up on your business.

Once you know the approach and teach your leadership team, then this will become part of your work culture. And the build-up will happen.

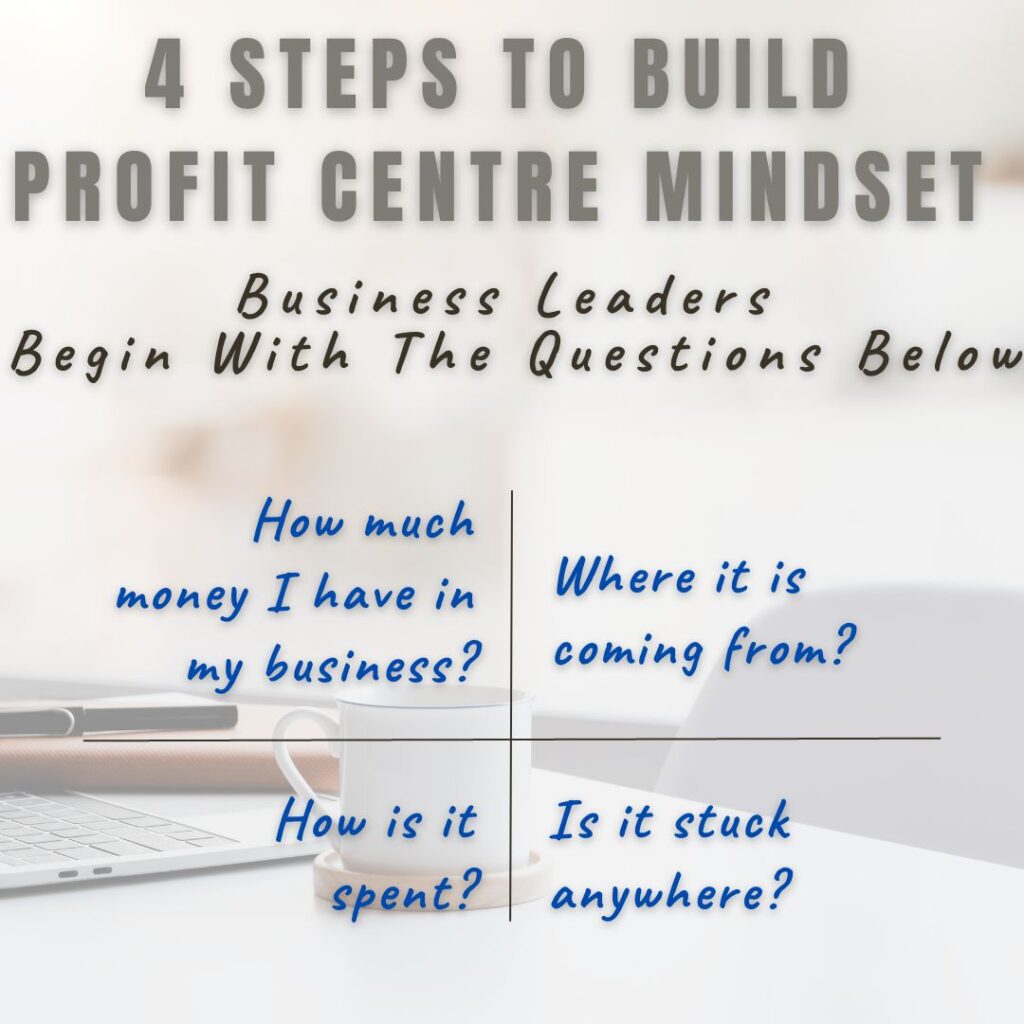

Let’s begin with the learning first….

High Impact Results

Profit centre management will bring in high impact result for,

Revenue verticals and it’s growth

Sources of additional revenue

Expense management and control

Inventory control

Sales management

Performance Management

HR process

Productivity

Cash flow management

Profitability and growth