Where has all the money gone?

Quite often business owners think, where has all the money gone?

To know exactly, you should know the money spread in business.

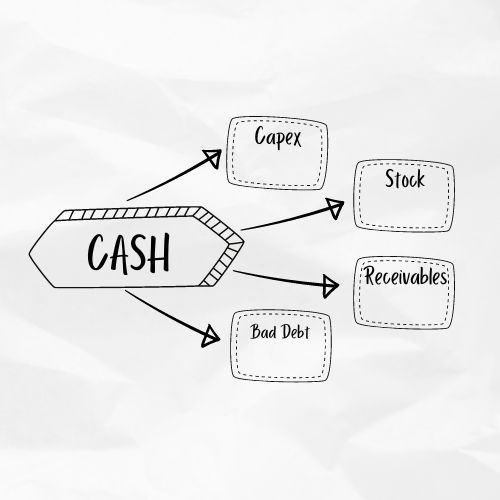

It could be on receivables, raw materials, work in progress, finished goods, advance payments. You must have an account of working capital and capex made as well.

Being a business owner, you must ask this question to your finance guy every month. He shall advice where you are recovering the blocked fund and where it is getting accumulated unnecessary. This review to be done weekly or monthly as your business warrant.

Beware of long outstanding receivables, they could actually be a bad debt. Old, obsolete, damaged stock are another channel for fund erosion.

Having a measurement to the fund management can bring a great control.

Let’s consider a simple example about receivables.

I didn’t pay my debts last 3 months?

I was on my way to see my client for the first time. My friend introduced me to him for a consulting. I was happy and elated.

But, the client’s first comment was, ‘I haven’t paid my debts last three months.’

Then he listed all the defaulted payments, such as a business loan, a home loan EMI, a credit card…

You might be thinking, what was the first thought that came to my mind, how is he going to pay me, then?

And I realized that my job is to help him get out of this situation, not to work for a pay-check.

I stopped him from going any further in explaining his company’s problems. Then compelled him to speak about the positive aspects of his business.

Count on your positive…..

He began listing it with great zeal, they are doing a much higher number of trades than previous year!

They’ve added three new product lines!

They added more employees to the team!

They are the market’s leading company!

Newly hired employees brought in new customers!!!

Then I knew my client was running a fantastic business. There could be a problem that he hasn’t identified.

As is customary, I began interviewing their team to learn more facts and figures.

Solution

Their concern was with billing and credit collection. It was never done on a regular and systematic basis. Due to a lack of management information, no one focused in this area. Billing and collection improved when MIS was available. And important business KPIs were also started monitored. As a result, employee performance and sales increased. Market share with good clients increased. MIS was providing the business with the appropriate direction at the appropriate time.

In fact, the client had a large money owed by his clients that was about two years’ worth of sales.

No one noticed about the money that had not collected on time. Even worse, they are unaware of the financial controls and reports to be on a daily basis.

And the client was able to recover from the financial crisis within a month. His cash flow balanced within three months. Within the next six months, they had repaid most of their loans.

Learning

Owners need not know know each and every management process. But they shall involve an expert to fix the necessary processes in place for every functions like accounting, HR, marketing, inventory, sales etc.

Owners responsibility is to ask questions to the relevant stake holder. This will be possible only if proper MIS is available. Questions, answers, decisions all should be based on figures.

On the other hand, lack of MIS will lead to fund erosion, revenues leakage and all sort of mis management of money.

Foundation of growing businesses are to be made on strong financial accounting system.